Conventional Loan Appraisal Requirements 2025

Conventional Loan Appraisal Requirements 2025. Government mortgage programs have specific requirements for appraisals that may differ from the standard type of appraisal used in conventional mortgage loans. In order to get a conventional loan, you need to meet basic lending requirements set by fannie mae, freddie mac, and your individual lender.

A conventional loan appraisal will receive a rating between c1 through c6. For most loans, fannie mae requires that the lender obtain a signed and complete appraisal report that accurately reflects the market value, condition, and marketability of the property.

Structural Integrity Of The Property.

A lender can help summarize your monthly payments, determine the overall interest you’ll pay and compare other pros and cons of each loan type.

For Fha Loans, Homes Must Adhere To Minimum Property Requirements (Mprs) Set By The Department Of Housing And Urban Development, Or Hud.

In order to get a conventional loan, you need to meet basic lending requirements set by fannie mae, freddie mac, and your individual lender.

Conventional Loan Appraisal Requirements 2025 Images References :

Source: www.slideteam.net

Source: www.slideteam.net

Conventional Loan Appraisal Requirements Ppt Powerpoint Presentation, We are having am appraisal but are worried if we will get accepted as. Upon identifying a potential property, the lender conducts a conventional home loan appraisal to ascertain its market value.

Source: ratechecker.com

Source: ratechecker.com

Conventional Loan Appraisal Requirements A Complete Guide, In a nutshell, a conventional loan or conventional mortgage is a homebuyer’s loan not secured (or offered) by the federal government (or any. Condition of the home, with specific.

Source: nationwidemortgageandrealty.net

Source: nationwidemortgageandrealty.net

Conventional Loan Appraisal Requirements Appraisal Guidelines, In this guide, we’ll explore what conventional loans are, the different types available, how they compare to fha loans, and the requirements to qualify. For fha loans, homes must adhere to minimum property requirements (mprs) set by the department of housing and urban development, or hud.

Source: statenislandallcash.com

Source: statenislandallcash.com

Conventional Loan Appraisal Requirements, Fha appraisal vs conventional appraisal. What is a conventional loan?

Source: nationwidemortgageandrealty.net

Source: nationwidemortgageandrealty.net

Conventional Loan Appraisal Requirements Appraisal Guidelines, In order to get a conventional loan, you need to meet basic lending requirements set by fannie mae, freddie mac, and your individual lender. Understanding the conventional appraisal guidelines and meeting loan appraisal standards is essential for.

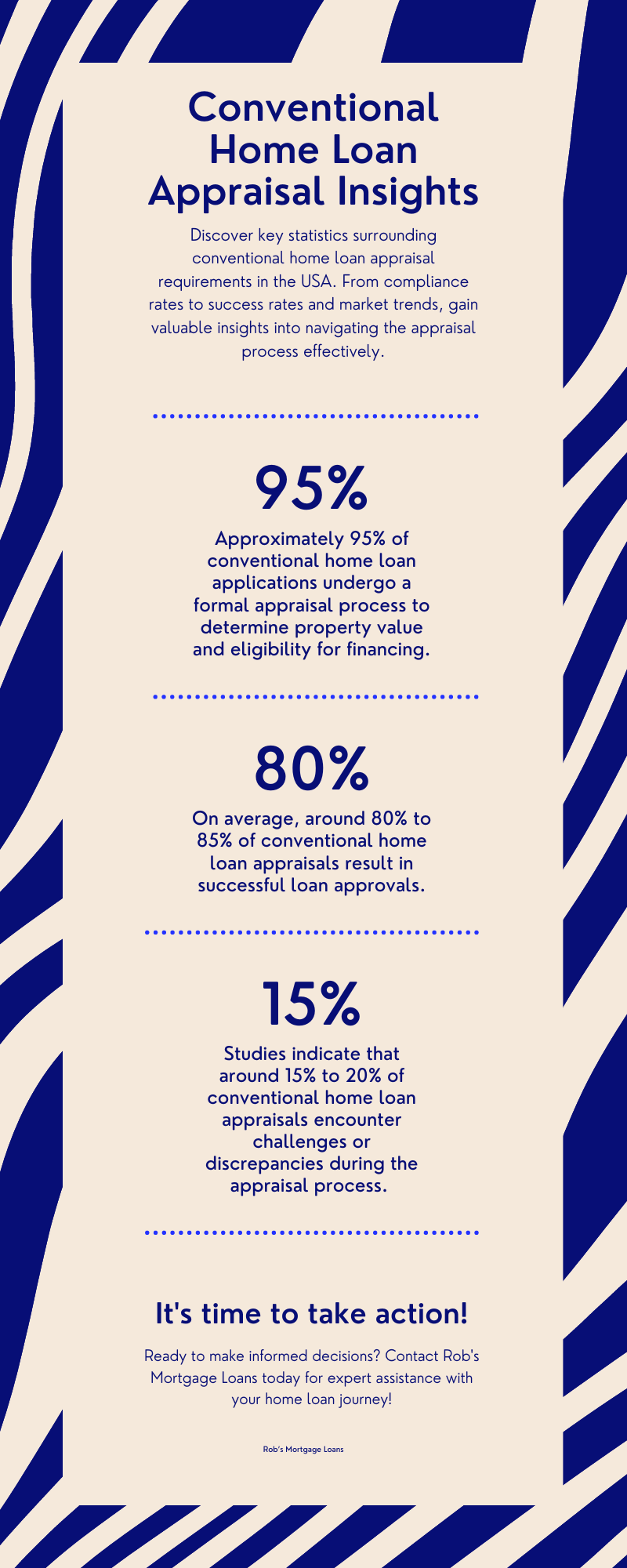

Source: robsmortgageloans.com

Source: robsmortgageloans.com

Conventional Loan Appraisal Requirements 2024 (+ Checklist), One crucial step is the conventional loan appraisal requirements. This process ensures that the property is worth the amount you’re borrowing.

Source: nflmortgage.com

Source: nflmortgage.com

What Are Appraisal Requirements for a Conventional Loan? North, This guide delves into what a conventional mortgage loan. Upon identifying a potential property, the lender conducts a conventional home loan appraisal to ascertain its market value.

Source: nationwidemortgageandrealty.net

Source: nationwidemortgageandrealty.net

Conventional Loan Appraisal Requirements Appraisal Guidelines, Understanding the intricacies of conventional loan appraisal requirements is essential in real estate financing. Condition of the home, with specific.

Conventional Loan Requirements for 2024, What is a conventional loan? Deficiencies cannot affect the following:

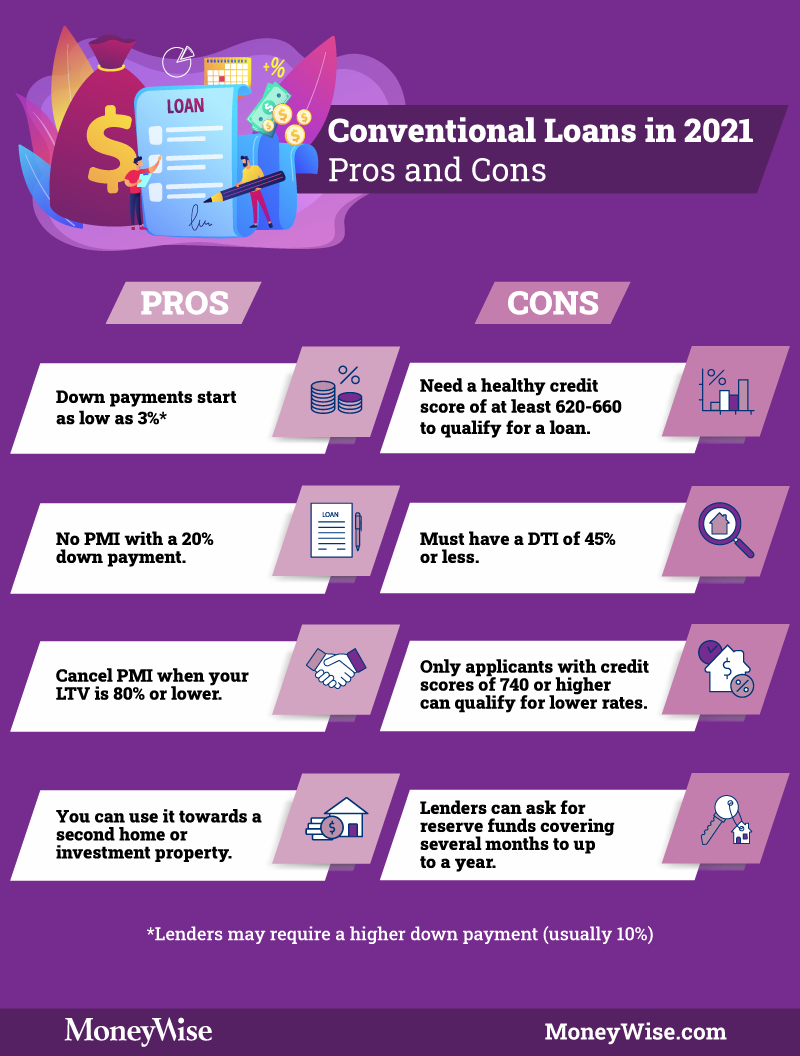

Source: moneywise.com

Source: moneywise.com

What Is a Conventional Loan? Requirements & Benefits Moneywise, For conventional loans, lenders expect the appraiser to check the following: A lender can help summarize your monthly payments, determine the overall interest you’ll pay and compare other pros and cons of each loan type.

We're Buying A Home With A Conventional Loan For 350K Purchase Price.

For fha loans, homes must adhere to minimum property requirements (mprs) set by the department of housing and urban development, or hud.

Among These, The Conventional Mortgage Loan Stands Out As A Popular Choice For Many Home Buyers.

We are having am appraisal but are worried if we will get accepted as.

Category: 2025